Abandoned History: Oldsmobile's Guidestar Navigation System and Other Cartography (Part V)

As we learned in our last installment in this series, the lowering of the digital and governmental barrier between civilian and military GPS assets in 1996 was a boon to the consumer side of navigation, and (per our comments) land surveying as well. It was a timely turn of events for General Motors after the Orlando area TravTek experiment of 1992 proved either too costly to scale, or alternatively not valuable enough in the eyes of consumers. Before we get to GuideStar, we need to cover much context around why GM was so keen on high-tech things in the Nineties, and the massive amounts of money it spent in its pursuit.

For that context we turn to GM CEO Roger Smith (pictured at left)(1925-2007), who was chairman of the company from 1981 to 1990. Smith admired large, diverse companies, particularly those like General Electric that had a business portfolio across many industries. Smith also saw tech as a way for GM to move toward the future. He wanted GM to become a company driven by technology, which looked less like traditional GM and more like a global conglomerate.

To make his dreams come true, Smith put the company’s money where his mouth was. In 1984 GM completed a deal to purchase a company called Electronic Data Systems, or EDS. EDS was founded in 1962 by former IBM man, billionaire, and future independent presidential candidate Ross Perot (1930-2019).

While at IBM, Perot saw how inefficiently end consumers used the company’s business computers, so he started what was essentially a third-party IT service provider. Proposed and implemented in 1967, Perot invented the business model which today is called outsourcing. An instant success, EDS became a very valuable company.

By the Eighties EDS was even larger, and didn’t come cheap. Smith forked over $2.5 billion ($7.4B adj.), and gave Perot pull at GM. There was immediate friction between the two men about employee pay, executives, and whether EDS would operate as an independent entity. Perot remained on the board of EDS and was its chairman and CEO, and (suddenly) was also GM's largest shareholder and newest board member.

The fight soon went public and was all over the news. The two men could not come to terms, and in 1986 Perot resigned from EDS and GM. The board approved a purchase of all of Perot’s stock for $750 million ($2.1B adj.). The payout for his exit had a stipulation: Perot was barred from discussing GM in any way.

But EDS was only the technology portion of Smith’s forward-looking plan to evolve GM. The other fork, he thought, was more advanced engineering. Around the time Perot was exiting the RenCen with a bucket of cash, another company entered the fold: Hughes Aircraft. The company was owned by the Howard Hughes Medical Institute in Maryland, which agreed to sell its aerospace branch to GM for $5.2 billion ($14.56B adj.).

Hughes was primarily a contractor in the defense and aerospace sectors, and was considered a leading manufacturer of satellites. GM merged Hughes into its Delco Electronics division to form the Hughes Electronics Corporation immediately. The new subsidiary immediately and continually expanded GM’s scope of product in strange ways, just as Smith wanted.

In 1987 Hughes purchased M/A-COM, a company that made business-related satellite products, and renamed it Hughes Network Systems. In 1994 Hughes introduced DirecTV satellite service. In 1995 the company became the world’s largest supplier of commercial satellites, and that same year the company purchased Magnavox Electronic Systems, the defense electronics arm of Magnavox. The entity was renamed Hughes Defense Communications.

But there were public issues with the Hughes deal as well, as the medical institute from which it was purchased sued GM. GM paid part of the $5.2B asking price with specially-created and newly-issued stock called “letter stock.” The stock was intended to pay dividends and had a guaranteed lowest base value in the final quarter of 1989, lest GM have to pay a cash penalty.

Hughes Medical alleged that the stock was not worth as much as it was supposed to be, had a lower dividend than intended and wanted a cash payout to make up the difference. Worth a mention, Perot was also issued letter stock, and that asset was what GM had to purchase to get him out the door. As Perot had just exited, the Howard Hughes Medical Institute became the new largest shareholder in GM.

Hughes medical and GM settled in March of 1989 for a $975 million ($2.41B adj.) payout. GM bought back their H-class shares, and Hughes agreed to strike the guaranteed $30 a share price from the agreement. Care to scroll upward and tally the tab here for GM’s expansion into technology and satellites?

It was during this contentious environment that people working at GM who were not Roger Smith attempted to see some sort of automotive value from all the dollars spent on EDS and Hughes. At the same time, GM was shedding workers and plants left and right. The company closed 11 plants in 1986 and cut 29,000 jobs, then unveiled a plan in February 1992 to close 12 more plants within three years, and 21 plants in total.

Indeed it would take years for General Motors to undo the damage caused by Smith’s purchase of EDS and Hughes Aircraft in his ill-conceived attempt to make GM look more like GE. One tangible car-related result of the two expenditures was short-lived and expensive in terms of money, facilities, and jobs: GuideStar GPS. We’ll pick up there next time.

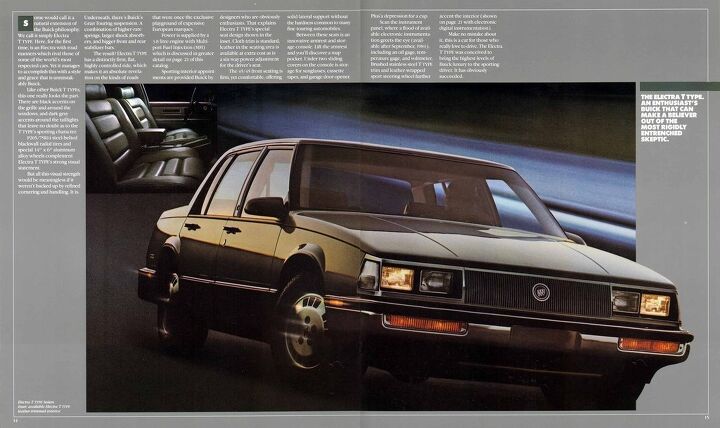

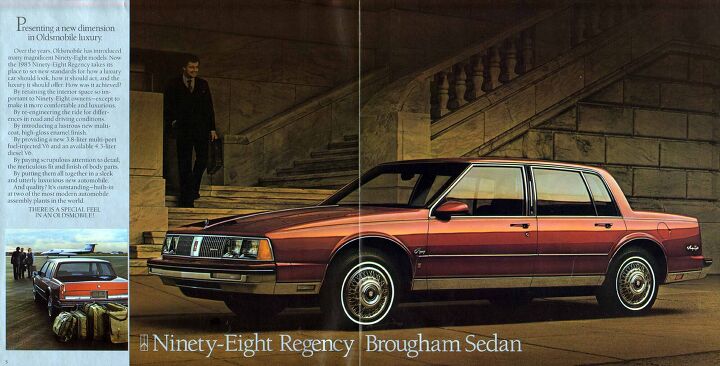

[Images: GM, EDS, Hughes, Magnavox]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

Interested in lots of cars and their various historical contexts. Started writing articles for TTAC in late 2016, when my first posts were QOTDs. From there I started a few new series like Rare Rides, Buy/Drive/Burn, Abandoned History, and most recently Rare Rides Icons. Operating from a home base in Cincinnati, Ohio, a relative auto journalist dead zone. Many of my articles are prompted by something I'll see on social media that sparks my interest and causes me to research. Finding articles and information from the early days of the internet and beyond that covers the little details lost to time: trim packages, color and wheel choices, interior fabrics. Beyond those, I'm fascinated by automotive industry experiments, both failures and successes. Lately I've taken an interest in AI, and generating "what if" type images for car models long dead. Reincarnating a modern Toyota Paseo, Lincoln Mark IX, or Isuzu Trooper through a text prompt is fun. Fun to post them on Twitter too, and watch people overreact. To that end, the social media I use most is Twitter, @CoreyLewis86. I also contribute pieces for Forbes Wheels and Forbes Home.

More by Corey Lewis

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka I have still yet to see a Malibu on the road that didn't have a rental sticker. So yeah, GM probably lost money on every one they sold but kept it to boost their CAFE numbers.I'm personally happy that I no longer have to dread being "upgraded" to a Maxima or a Malibu anymore. And thankfully Altima is also on its way out.

- Tassos Under incompetent, affirmative action hire Mary Barra, GM has been shooting itself in the foot on a daily basis.Whether the Malibu cancellation has been one of these shootings is NOT obvious at all.GM should be run as a PROFITABLE BUSINESS and NOT as an outfit that satisfies everybody and his mother in law's pet preferences.IF the Malibu was UNPROFITABLE, it SHOULD be canceled.More generally, if its SEGMENT is Unprofitable, and HALF the makers cancel their midsize sedans, not only will it lead to the SURVIVAL OF THE FITTEST ones, but the survivors will obviously be more profitable if the LOSERS were kept being produced and the SMALL PIE of midsize sedans would yield slim pickings for every participant.SO NO, I APPROVE of the demise of the unprofitable Malibu, and hope Nissan does the same to the Altima, Hyundai with the SOnata, Mazda with the Mazda 6, and as many others as it takes to make the REMAINING players, like the Excellent, sporty Accord and the Bulletproof Reliable, cheap to maintain CAMRY, more profitable and affordable.

- GregLocock Car companies can only really sell cars that people who are new car buyers will pay a profitable price for. As it turns out fewer and fewer new car buyers want sedans. Large sedans can be nice to drive, certainly, but the number of new car buyers (the only ones that matter in this discussion) are prepared to sacrifice steering and handling for more obvious things like passenger and cargo space, or even some attempt at off roading. We know US new car buyers don't really care about handling because they fell for FWD in large cars.

- Slavuta Why is everybody sweating? Like sedans? - go buy one. Better - 2. Let CRV/RAV rust on the dealer lot. I have 3 sedans on the driveway. My neighbor - 2. Neighbors on each of our other side - 8 SUVs.

- Theflyersfan With sedans, especially, I wonder how many of those sales are to rental fleets. With the exception of the Civic and Accord, there are still rows of sedans mixed in with the RAV4s at every airport rental lot. I doubt the breakdown in sales is publicly published, so who knows... GM isn't out of the sedan business - Cadillac exists and I can't believe I'm typing this but they are actually decent - and I think they are making a huge mistake, especially if there's an extended oil price hike (cough...Iran...cough) and people want smaller and hybrids. But if one is only tied to the quarterly shareholder reports and not trends and the big picture, bad decisions like this get made.

Comments

Join the conversation

That Saturn looks like a JBody lol

That red-ish colored Olds 98 is the bomb. I'd love to find a mint survivor just like it.